The consumer electronics market witnesses a reshuffle approximately every six years, so TWS earbuds now have a 3-4 years rapid growth period.

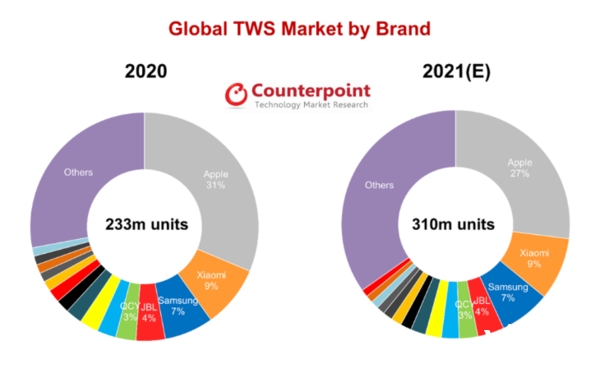

At Apple's autumn conference in 2016, Apple's flagship product iPhone7 / 7Plus failed to impress consumers. Instead, the new product AirPods wireless earbuds that were launched to replace the 3.5mm earbuds connector on the mobile phone aroused consumers' strong interest. Even if the AirPods sales date was delayed and it took at least a month and a half to receive a new product after launch, it didn’t stop many consumers from buying. According to a report this year by Strategy Analytics, a market research firm, sales of true wireless stereo (TWS) Bluetooth earbuds exceeded 300 million in 2020, with Apple AirPods accounting for nearly half of the market share.

"AirPods can bring users more comfortable product experience, so users quickly accept this new product. Only with a solid foundation can we go further. We did not hesitate to enter the TWS market and were sure that the market would grow up at that time. Our performance today has proved that our prediction is correct. ", Dong Guanbin, General Manager of Thinkplus Semiconductor, told the media in the company's 10th anniversary celebration.

Dong Guanbin, General Manager of Thinkplus Semiconductor

With a solid foundation, Thinkplus Semiconductor became the sales champion in the TWS earbuds power management IC market this year. According to the ranking of TWS power management IC shipment volume released by Sunrise Big Data, Thinkplus Semiconductor shipped 24.3 million ICs in March 2021, surpassing Texas Instruments that ranked second.

Thinkplus Semiconductor, which witnessed the ups and downs of the consumer electronics industry in the past 10 years, has attracted more attention due to the popularity of the TWS market, but there is a story worth recalling behind its "victory".

"Sales Champion" in TWS Earbuds

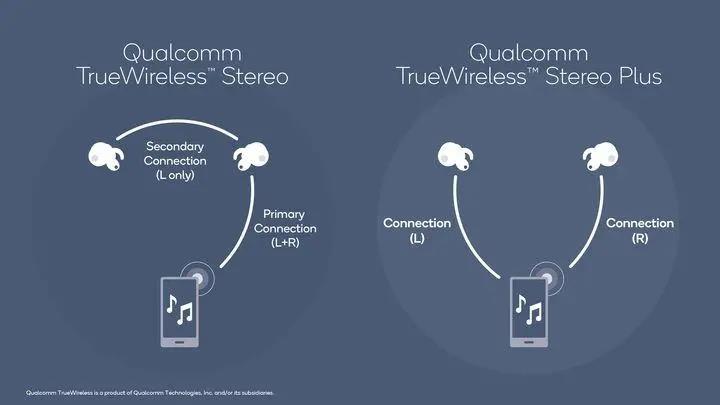

The wireless earbuds before AirPods are not really wireless because of technical limitations. This kind of wireless earbuds can only be connected to the mobile phone through the main earbuds, and then the cable transmits the audio signal to the secondary earbuds, so they are neck-hanging products.

The revolutionary significance of AirPods lies in solving the technical problem of connection between the mobile phone and the Bluetooth wireless earbuds. Two earbuds can be connected with the mobile phone at the same time, and there is no master-slave distinction between the left and right earbuds, realizing the wireless separation of the true wireless stereo channels and maintaining sound synchronization.

According to Apple's test results, the AirPods with cradle have a battery life of more than 24 hours, favored by millions of consumers.

True wireless stereo (TWS) and long battery life make AirPods a hit in the TWS earbuds market. TWS earbuds, which cost 10 times less than AirPods, began to hit the market at the end of 2018, ushering in the era of universal popularity in two years. According to a market research firm Counterpoint, the sales in the global TWS earbuds market reached 233 million in 2020, 78% up from a year earlier. Based on the forecast, up to 310 million TWS earbuds will be sold in 2021, 33% up from a year earlier.

The rapidly growing market brings great opportunities to companies in this industry chain, such as power management IC, which affects the experience of TWS earbuds. And the role of power management IC in electronic equipment systems is to transform, distribute and detect electrical energy, directly affecting the overall experience of the products, and battery-powered mobile devices have higher requirements for power management IC.

"We entered the TWS market without hesitation in 2017 before its potential was realized, and our results today confirm that the prediction is correct," Dong said, "Our brand customers will surely capture the market opportunities from end users, the same as that we capture from our brand customers. We first captured the the chances of small vendors and brand customers, eventually forming a market-leading advantage."

According to Leiphone.com, the proportion of IC shipment volume of Thinkplus Semiconductor to small vendor customers in the TWS market is 70%, and that of IC shipment volume to brand customers is 50%. In the future, this proportion will exceed the proportion of IC shipment volume to small vendor customers and reach 80%.

In general, Thinkplus Semiconductor has shipped 700 million TWS cradle SoCs in recent two years, ranking first in market share, and has applied for and obtained more than 60 independent intellectual property rights. Its customer group includes Xiaomi, OPPO, OnePlus, realme, Transsion, Meizu, 1MORE, Baidu, NetEase, EDIFIER, JBL, Anker, Harman, Motorola, etc.

As for TWS power management IC shipment volume of Thinkplus Semiconductor surpassing analog IC leader TI in this March, Dong Guanbin modestly said that it may be a "tiger snooze " - a rare opportunity. He also pointed out the advantages of Chinese IC companies, including fast response to customer needs through localized services, fully meeting customer needs, and shortening the launch time.

"Many system definition has been done by European and US companies over the past several decades. If we want to solve the problems concerning Chinese ICs thoroughly, we still need to solve the underlying system problems," Dong told Leiphone, "We have focused on the development of power management ICs and battery management ICs over the past decade, achieved breakthroughs in basic key technologies, and almost completed the accumulation of all relevant basic technical architectures."

Three Breakthroughs of "Sales Champion" in Ten Years

When Dong founded Thinkplus Semiconductor in Shenzhen in 2011, he was starting from scratch. At that time, there were not many Chinese power management IC companies, but Dong still chose to enter the power management IC market. "The reason for choosing the field of power management ICs is that power management ICs are needed in all electronic products, and the market demand is very large; in addition, the constant change of this market will bring many new demands and opportunities, " explained Dong.

Dong's idea of starting a business was inspired by the entrepreneurial story of Fosun, and had been preparing for a decade in product development, supply chain and sales before starting a business.

"In 2011, I felt ready and thought that it was the right time to start a business," Dong recalled, "When we were developing our first product, the R&D director and I worked until 1 a.m. every day for a month to solve one problem. It is with such persistence that we could make breakthroughs and become experienced in all related basic technologies for power management IC."

When a young company is facing market changes, every breakthrough it has made is not easy, and Dong said his company went through three key development nodes in the past decade. The first key node is the first three years of the founding of Thinkplus Semiconductor. They had only one customer and provided customized products, producing nearly 60 ICs in total.

"In the fourth year of our founding, we started our business in power bank ICs. However, due to the change in product specifications, we had three failed attempts before success, but when we succeeded, we found that we had lost our opportunities in the market. Fortunately and unforgettably, we later got the first order in the power bank market. The ordered quantity reached 1 million. At that time, I started to believe customers would come as long as we could provide the right products." Dong also found the significance of such twists and turns for Thinkplus Semiconductor in the TWS market.

"In retrospect, the reason why we could seize the opportunity of product renewal in the TWS market is that we had accumulated much experience. During that period of time, we had a deeper understanding of the product renewal, the understanding of the market and customers."

By 2016, Thinkplus Semiconductor ranked first in the industry in the shipment volume of 1A power bank SoC. In 2017, the shipment volume of power bank ICs exceeded 80 million. At the same time, Thinkplus Semiconductor went through its third key development node, namely the year before the TWS market boomed.

"We entered the TWS earbuds market without hesitation and believed that we could succeed here." Dong Guanbin said that when they started business in this market, they had discussions and designed products together with Antexin, a partner with deep technology accumulation. Then our products were applied to key projects of many important domestic companies, helping Thinkplus Semiconductor gain a firm foothold in this market.

At the same time, Thinkplus Semiconductor cultivated its industry-leading capabilities step by step by proactively capturing customer needs and thorny problems. A good example is the fast charging cradle for TWS earbuds, which have already been widely used in mobile phones but not yet available on TWS earbuds. "We have achieved mass production of the first generation of the fast charging IC for TWS earbuds last year and are about to launch the second generation products. We are already ahead of international manufacturers and have advantages in the product volume, power density and power dissipation," said Dong.

Dong believes that Thinkplus Semiconductor has cultivated three core strengths after 10 years of efforts. The first is keen market insight. The company is willing to understand the needs of customers and solve problems together with customers, so as to promote the development of the industry. Second, the company has the courage to face challenges and solve problems effectively. The third is the company's continued investment in research and development to help tackle key issues.

Next Target Market

The consumer electronics market is characterized by rapid change, so the key to staying competitive in this massive market is to constantly adapt to changes. Dong shared, "According to our understanding of the law of consumer electronics market for so many years, consumer electronics products will be upgraded once every two years, and a market reshuffle will be observed after three product upgrades, namely 6 years. The TWS earbuds market now has a 3-4-year rapid growth period."

"We have begun to plan the development and marketing of power management ICs for other wearable products, including smart watches and VR. For these space-constrained products, the power management IC needs higher power density, smaller size, and ultra-low standby power dissipation," Dong said.

Thinkplus Semiconductor, which has a strong record in consumer electronics, is also preparing to enter the industry and automotive electronics market. This is because there is still a big gap between Chinese IC companies and global leaders in the industrial, automotive and medical sectors.

But Dong also pointed out, "The core reason why China's IC industry has been able to continually develop over the past 20 years is that the development of system manufacturers has driven the development of Chinese IC supply chain. Of course, thanks to the achievements of advanced manufacturing, we can develop more high-performance products. I believe the same is true for the automotive industry, where automotive software systems manufacturers must be willing to give domestic semiconductor companies the opportunity to grow together for fostering a domestic supply chain system."

"There is still a long way to go for domestic IC products, but we are confident about the future."

It is also crucial that we trust and support each other. "Since 2017, we have built trust with our customers by focusing on the overall planning of the market and delivering the promised products each year. In the face of current challenges, the whole industry chain needs to work together to minimize the impact of insufficient IC production capacity." Dong predicted that the IC product output shortage will continue for a while, and such pressure may be relieved until the third quarter of next year.

Words in the End

Domestic analog IC products are less attracted to customers than domestic high-end digital IC products. In fact, analog ICs constitute one of the most important market segments and are essential power management ICs for all electronic products. However, this market has been dominated by European and American industry giants for decades. Therefore, we should be proud of Thinkplus Semiconductor, which has been focusing on power management ICs and battery management ICs for ten years and has successfully broken the foreign technology monopoly.

For IC design companies in China, if they want to break through the technology and market barriers of European and American industry giants, they not only need to have solid technology accumulation, but also need to grasp the rapidly changing market demand, and more importantly, need to improve the domestic advanced manufacturing capacity and the strong strength of domestic IC system companies. Behind this, there needs to be a lot of companies with long-term development strategies like Thinkplus Semiconductor, to lock in the right direction, and make breakthroughs one by one, thus pushing IC industry in China into a leading role globally.

Previous articleCommercial Use | PMIC SY5500 Favored by OnePlus and Other Brands2021.09.09

Next articleTen Years of Efforts Lead to Bright Future | Thinkplus Semiconductor Celebrates the 10th Anniversary2021.08.07